This section will allow you to set up an account with the Office of Tax and Revenue (OTR), register your business using your Federal EIN and complete your Clean Hands Certificate.

- OTR Account

- Register your business (FR 500)

- Clean Hands Certificate

OTR Account

You must have an account with the Office of Tax and Revenue for all tax related matters including registering your business’s FEIN and getting a Clean Hands Certificate.

Note: If you have an accountant who already has an OTR account for you, please check with him/her. You will not be able to set up a separate account for your own use if one already exists.

- Here’s the website for OTR: My Tax DC and here’s the sign up site.

- You will need to create a username and password

- Problems using My Tax DC, call: 202-759-1946 or email: E-services.otr@dc.gov

Register Your Business with OTR (FR 500)

OTR has a complete explanation of how to fill out the FR 500 on their website (link). (Here is the paper version).

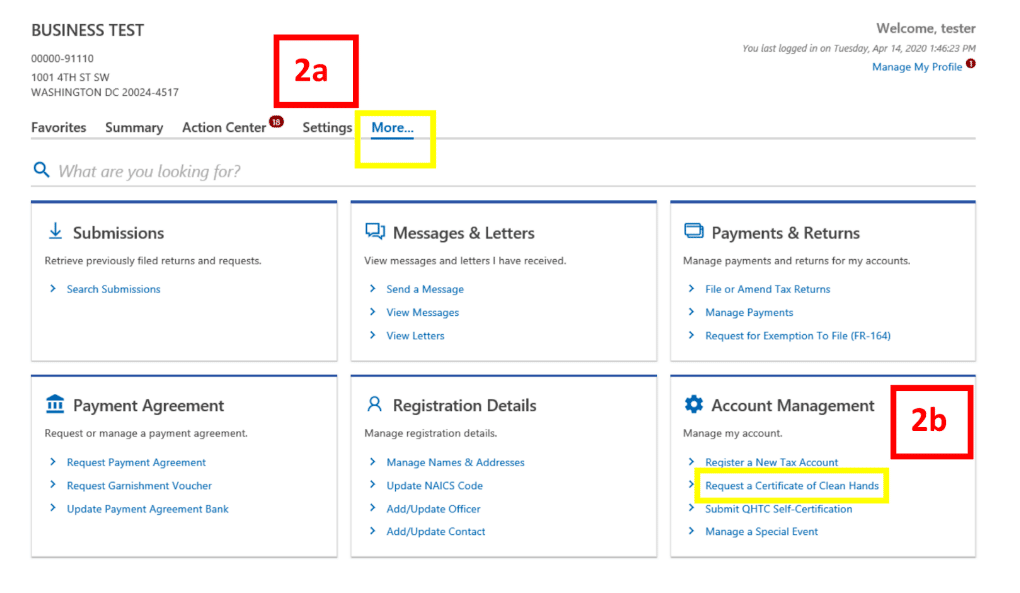

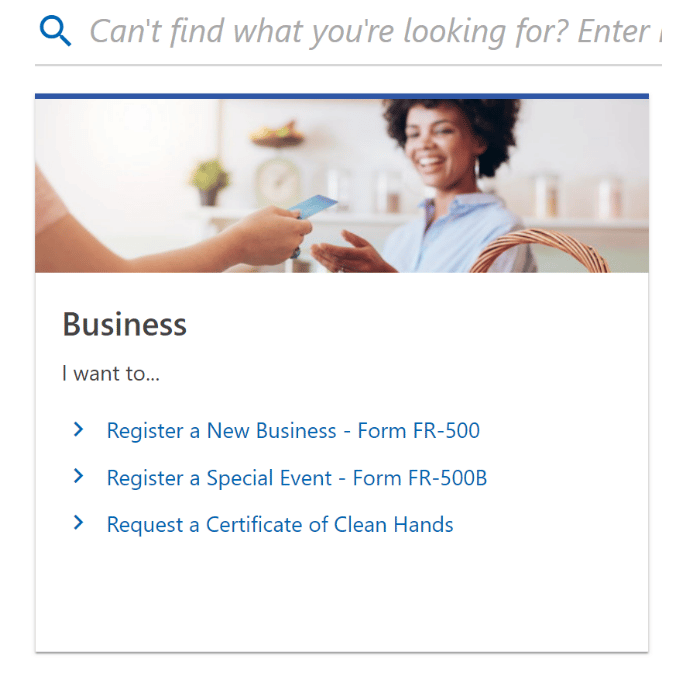

When you log into My Tax DC, go to the Business tile and click on “Register A New Business” – Form FR-500

You will need:

- All your DLCP licensing information must be complete (link)

- Have your FEIN

- Information about other tax liabilities such as sales tax, personal property tax

- Type of business information (LLC, SP, etc)

- Primary business address

- Names, addresses, and information (social security number) for any business partners

- Information about any prior businesses you have owned in the District in the past

- Other information includes your, DBA/Trade Name, NAICS and your business’ officer names

- Other eligible tax information

Other information to know:

OTR has a FAQ on additional eligible tax accounts that explains Sales and Use, Alcoholic Beverages, Ballpark fee, property tax, etc.

- Business Franchise Tax or Unincorporated Business Franchise Tax

- Business Franchise Tax (LLCs). The current rate is 8.25% and the minimums are:

- $250 minimum tax, if DC gross receipts are $1 million or less

- $1000 minimum tax, if DC gross receipts are more than $1 million

- Unincorporated Business Franchise Tax (Sole Proprietorships, Partnerships, any income over $12,000). The current rate is 8.25% and the minimums are:

- $250 minimum tax, if DC gross receipts are $1 million or less

- $1000 minimum tax, if DC gross receipts are more than $1 million

- Business Franchise Tax (LLCs). The current rate is 8.25% and the minimums are:

Clean Hands Certificate

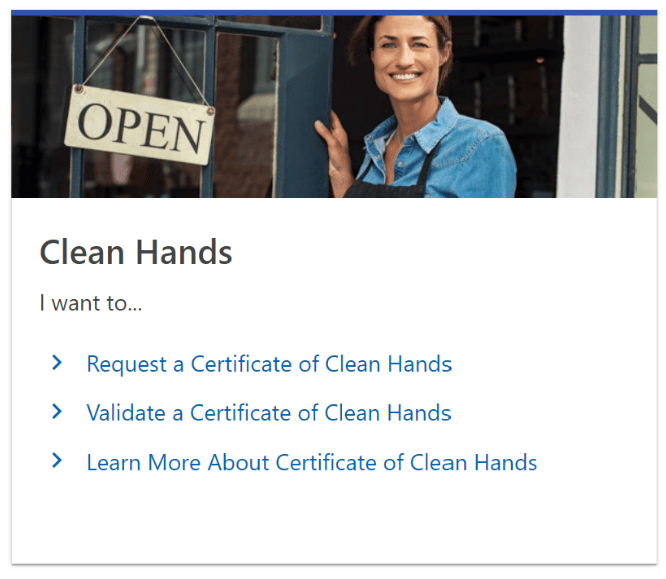

The Clean Hands Certificate must be done online through the OTR Website: MyTaxDC.gov

Clean Hands definition: You cannot owe more than $100, must have filed all required tax returns and must be in compliance with all DC agencies (eg. Department of Health or ABRA).

A Clean Hands Certificate may be verified online

If you have questions, you can call: 202-724-5045 or email cleanhands.cert@dc.gov

OTR has a complete explanation and a video on how to complete the Clean Hands Application and a video.

Businesses must use the online application for a Clean Hands Certificate

- When you log into My Tax DC, go to the Business tile or the Clean Hands Tile

- Once you’ve completed the application online, go to your message center to receive a copy of your Clean Hand Certificate or find out the reason you cannot receive it at this time.